OP Stack chains are an integral part of the OP Superchain ecosystem. OP Stack L2/L3s account for over 54.2% of total Superchain transactions and contribute 42.5% of Superchain revenue.

You may know that each OP Chain is accountable for contributing a portion of its protocol fee to the Optimism collective, thereby powering the Ethereum ecosystem to grow on an internet-level scale.

This article explores the revenue contribution of OP Stack chains to the Optimism collective and its benefit to the Ethereum blockchain. Before that, let’s quickly learn about OP Stack’s features that are shaping Ethereum’s rollup-focused vision.

A brief about OP Stack and its features supporting Ethereum’s rollup-centric vision

OP Stack is a open-source, modular, and scalable framework optimized with the most-mainnet ready features and upgrades. OP Stack encourages application to build their custom, single-use chain with the option to settle on Ethereum (as L2) and on any OP Stack L2 (as L3). OP Stack offers a range of features that compliments Ethereum’s rollup-centric roadmap such as:

Stage1 Decentralization with permissionless fault proof.

Alternative DA mode (beta).

Custom tokens (beta)

RIP-7212 alignment.

Native interoperability layer (upcoming).

Superchain registry (upcoming).

Blockspace charter (upcoming).

And, more. If you want to learn in-depth details about OP Stack’s features & upgrades (live and upcoming), read the article linked below: What’s Hot on OP Stack? 2024’s Latest upgrades and What’s Coming?

Tracing OP Stack’s Revenue contribution to Optimism Collective: A Historical Breakdown

As a Ethereum scaling solution, OP Stack has a considerable focus on powering Ethereum towards a more rollup-centric future. Hence, every OP Stack chains is accountable to either contribute 2.5% of its L2 revenue or 15% of gross profit to the Optimism collective, which is a band of communities, companies, and citizens working together to create a highly sustainable future for Ethereum.

The revenue in OP Stack chains mainly come from transaction fees, sequencing fees, MEV (Maximal Extractable Value), staking & governance. In our previous article on OP Stack & Ethereum 2.0, we highlighted that $7Billion that has been bridged from Ethereum Layer1 to OP Superchain as of April 2024. That means a good transaction fee goes to Ethereum. Now, let’s deep dive into the historical breakdown of OP Stack revenue contribution to Ethereum.

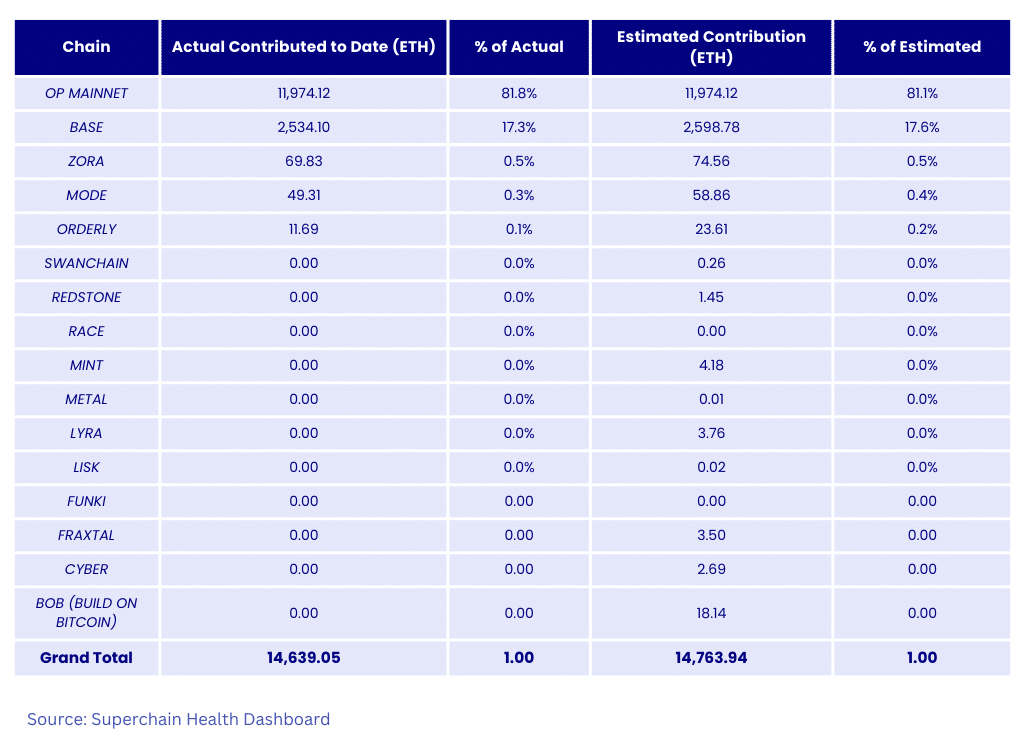

Below is a data table showing all-time contribution of OP Stack chain’s revenue contribution to Ethereum. The data essentially refers to ETH transferred from each OP Stack chain to the Optimism collective. Note that the contribution is calculated via the standard revenue contribution model of 15% or 2.5%.

As you can see in the table, there are total of 16 OP Stack chains that are expected to share their revenue to Ethereum. However, to date, the actual contribution is coming from top-5 chains; OP Mainnet, Base, Mode, and Orderly Network. Note that Optimism collective assumes that OP Mainnet will contribute its 100% net on-chain profit.

Now, let’s dive deeper into the revenue and profit-related metrics of all these OP Chains to understand how much traction they are getting and how OP Stack contributes revenue to Ethereum. The data mentioned here are collected from prominent analytics platforms like Token Terminal, Dune Analytics, DeFi Lama, Growthpie, L2Beat, and more.

OP Mainnnet: 81.8% Contribution

OP Mainnet is the oldest OP rollup chain built with the initial version of OP Stack framework and later integrated in line with the Bedrock upgrade. OP mainnet shares features similar to the standard rollup stack, including Ethereum-equivalency, low-cost processing, EIP-1559 support, blobspace, and so on.

OP Mainnet is a leading contributor to Superchain and Ethereum ecosystem with its TVL of $6.73B and 515.92K total transactions, 60.57K active addresses, plus current bridge deposit of $4.113B.. Talking specifically about revenue and gross profit, OP Mainnet made $2.760M revenue in Q3 2024 while the gross profit was 2.752M for this same quarter. Further, the highest revenue was spotted in Q2, 2024 at $8.948M.

Here’s a historical breakdown of OP Mainnet’s revenue and gross profit:

Base Layer2: 17.3%

Base is the top-performant chain in the OP Superchain ecosystem that is getting overwhelming popularity due to its Coinbase-backing and offerings like safe, low-cost, and developer-friendly network to build next-gen applications.

Base makes more than 80% of OP Superchain revenue with a TVL of $1.51B, 4.12M total transactions, and on-chain profit of $55.50K. Regarding the revenue and gross profit, Base has seen $4.869M total revenue in Q3 2024 while its gross profit has been $4.142M for the same time period. Whereas, the peaked revenue in Base was recorded in Q2 2024 at $27.307M revenue and $15.448M as gross profit. Also, Base had a bridged depost of $4.113B in Q3 2024. Here’s a quarter-wise historical breakdown of Base’s revenue and gross profit metrics:

Zora: 0.5%

Next is Zora Network that settles on Ethereum while being an integral part of OP Superchain ecosystem. Zora stands out with features like cheaper transactions (NFT costs less than $0.50), gasless transactions, and massive scalability.

As one of the top-performing OP Stack L2s, Zora grabs a TVL of $20.78M, and it has 3.11M total on-chain transactions and 21.39K active addresses. Speaking about the revenue, Zora recorded $55.649K as revenue in Q3 2024 and it has bridged deposit of $24.013M in the same timeline. Meanwhile, Zora’s highest revenue is seen in Q1 2023 at $1.445M. Find the historical breakdown of data here:

Mode: 0.3%

Mode is a modular DeFi-based L2 built with OP Stack to empower a whole ecosystem of world-class applications. Optimized with a Bedrock upgrade, Mode offers projects that benefit from 95% less fees than Ethereum while leveraging other rollup features like scalability, L1-based security, and interoperability.

Mode adds itself to the list of high-traction OP Stack chains with a TVL of $482.18M, 3.80M total transaction count, and 6.05K active addresses. Looking at the revenue, Mode’s on-chain profit was recorded at $386.68 in Q3 2024, while the highest profit was seen in Q1 2024. Here’s a breakdown:

Orderly Network: 0.1%

Orderly Network is OP Stack chain designed as decentralized oderbook protocol for offering high-performance and low-latecy infrastructure for DeFi & trading. Transparency, efficiency, security, and self-custody are the key features of Orderly Network that powers future-proof applications.

As of now, Orderly Network has a TVL of $22.37M, 1.10M transactions (30 days), and 420.225K active accounts. Specific information about revenue and gross profit of the chain is not available. However, the bridge deposit of Orderly Network was recorded at $667.525k in Q3 2024 while the highest deposit was seen in Q2 2024, at $779.053k.

How OP Stack chain’s revenue contribution benefits Ethereum?

OP Stack chain’s revenue contribution to Optimism collective offers the following main benefits to the Ethereum ecosystem:

Creation & sustainability of public goods:

The funds shared from Optimism collective is leveraged for creation and sustainability of public goods on Ethereum and Optimism, such as infrastructure improvements, tooling, research, and development. This allow Ethereum’s critical components to evolve overtime in a impact-driven approach.

Expansion of the Ethereum network:

Funds from Optimism collective are further utilized to incentivise pioneers for building OP Chains (settling on Ethereum) or laying groundwork to flourish public goods . This directly increases Ethereum’s utility and adoption while also leading to greater network effects.

Fostering Innovation and development:

Optimism collective use OP Chains’ revenue share to brings new-age innovation and bring initiatives to encourage Ethereum advancement. A good example of this is decentralized governance. Revenue contribution can help Ethereum projects evolve in a more community-driven and sustainable manner, keeping the core the principles of decentralization intact.

Launching your OP Stack L2? Set up production-ready Testnet with Zeeve RaaS

As discussed, OP Stack is the most-matured and mainnet-ready framework for building optimistic rollups L2s. Considering this, OP Stack is right now the leading choice for web3 projects. If you are planning to launch your L2 or L3, Zeeve RaaS platform offers you a low-code, 1-click deployment sandbox tool. It allows you to setup production-ready testnet in minutes. All the necessary 3rd party rollup integrations like the Alt-DA layer, decentralized sequencers, data indexers, account abstraction layer, wallets, and bridges are supported on Zeeve Raas and can be integrated with a click. For more information, connect with our experts or navigate the Zeeve RaaS platform. Try yourself!